JPMorgan and the spoof of July 20th, 2009

One of the examples described by the CFTC involved JPMorgan spoofing in the Treasury Bond September 2009 futures market. In the span of 8.7 seconds, JPMorgan placed and cancelled six layers of spoof orders, with each spoof order having a volume of 300 contracts. This specific example resulted in JPMorgan being able to sell one hundred futures contracts for $3743.5 more through spoofing.

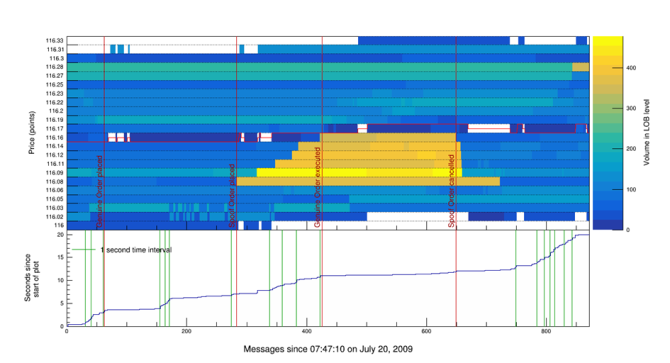

Figure 1 is a simplified version of the visualizations in the article, showcasing the market circumstances around this particular spoof. In this particular spoof, JPMorgan wanted to sell one hundred contracts for 116.172 points which was higher than the market price at that moment (116.141 points). In the figure, a “hotspot” of yellow bars catches the eye. JPMorgan added six spoof orders, from level six to level one, each with a volume of 300 contracts. This can be seen by the bright yellow bars starting the moment spoof orders were added (second vertical red line). After JPMorgan sold the hundred contracts they intended to sell (the third red vertical line), the spoof orders were cancelled as can be seen by the disappearing yellow bars (the fourth red vertical line) Spoofing completed!